Economic data under the microscope, but surveys may be skewed by pol

U.S. stocks took a hiatus from record highs as the financial markets hit the pause button ahead of Friday’s big inflation data drop. The initial euphoria from the Fed’s jumbo rate cut is fading, and all eyes are now on the economy, with every macro tidbit under a microscope. Investors are weighing whether the Fed's move is enough to keep things humming.

Ironically, Treasury yields ticked up after sinking on a surprisingly weak U.S. consumer confidence report the day before. The worst drop in three years stirred up fresh fears about the U.S. economy’s resilience. The big talk is about the “jobs plentiful” vs. “jobs hard to get” gauge, which slid to lows not seen since early 2017. This kind of data has people questioning the economy's strength, but the markets are always ready to flip the narrative. As yields rose, the U.S. dollar regained some ground, especially against the yen, with the Bank of Japan showing no urgency to hike rates.

Recent News

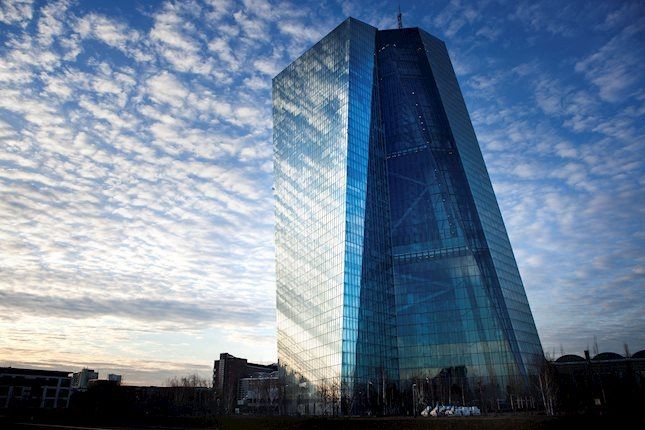

Will the ECB be forced to follow the Fed...

July 20, 2024

Rates & Charts

Australian Dollar receives support from...

July 20, 2024

Rates & Charts

Ethereum's takes 2% downturn as CoinShar...

July 20, 2024

Rates & Charts

GBP/USD edges higher amid modest USD dow...

July 20, 2024

Rates & Charts

USD/JPY: Set to recover further to 145.5...

July 20, 2024

Rates & Charts