On the path to widespread monetary easing in Asia

Bank Indonesia unexpectedly cut its monetary policy rates on 18 September (-25 bps). This easing was largely due to the rupiah strengthening against the USD since August (+6.4%).

As a result, Bank Indonesia is the first central bank from the emerging countries in South Asia (excluding the Philippines) to cut its interest rates. This movement, which is expected to be followed by a further interest rates cut before the end of the year, is not expected to be a one-off.

The FED rate cut (-50 bps) and the subsequent appreciation of currencies against the USD will provide greater flexibility for monetary authorities, which will remain cautious nevertheless. Asian currencies are structurally volatile and highly exposed to changes in US monetary policy, whereas one of the key objectives of the central banks is keeping them stable.

Recent News

AUD/JPY retakes 99.00 mark and beyond, u...

July 20, 2024

Rates & Charts

EUR/USD strengthens to near 1.1150 ahead...

July 20, 2024

Rates & Charts

USD/CHF: SNB in focus tomorrow – OCBC

July 20, 2024

Rates & Charts

RBA widely expected to keep key interest...

July 20, 2024

Rates & Charts

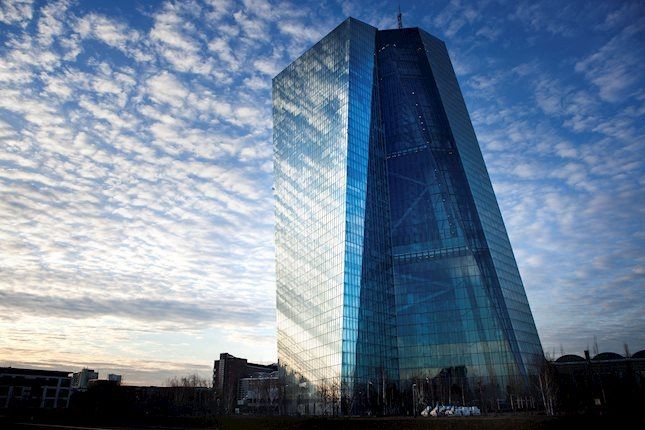

Will the ECB be forced to follow the Fed...

July 20, 2024

Rates & Charts